How Much Is Sales Tax On A Vehicle In Illinois . when you choose to lease a car in illinois, you’ll pay sales tax on the cost of your new or used car — the key factor is that you’ll. sales taxes in illinois are calculated before rebates are applied, so the buyer who pays $9,500 after a $2,500 rebate will still pay sales tax on the full $12,000. illinois private party vehicle use tax is based on the purchase price (or fair market value) of the motor vehicle, with exceptions. illinois private party vehicle use tax is based on the purchase price (or fair market value) of the motor vehicle, with exceptions. The tax is imposed on motor vehicles purchased (or acquired by gift or transfer) from another individual or private.

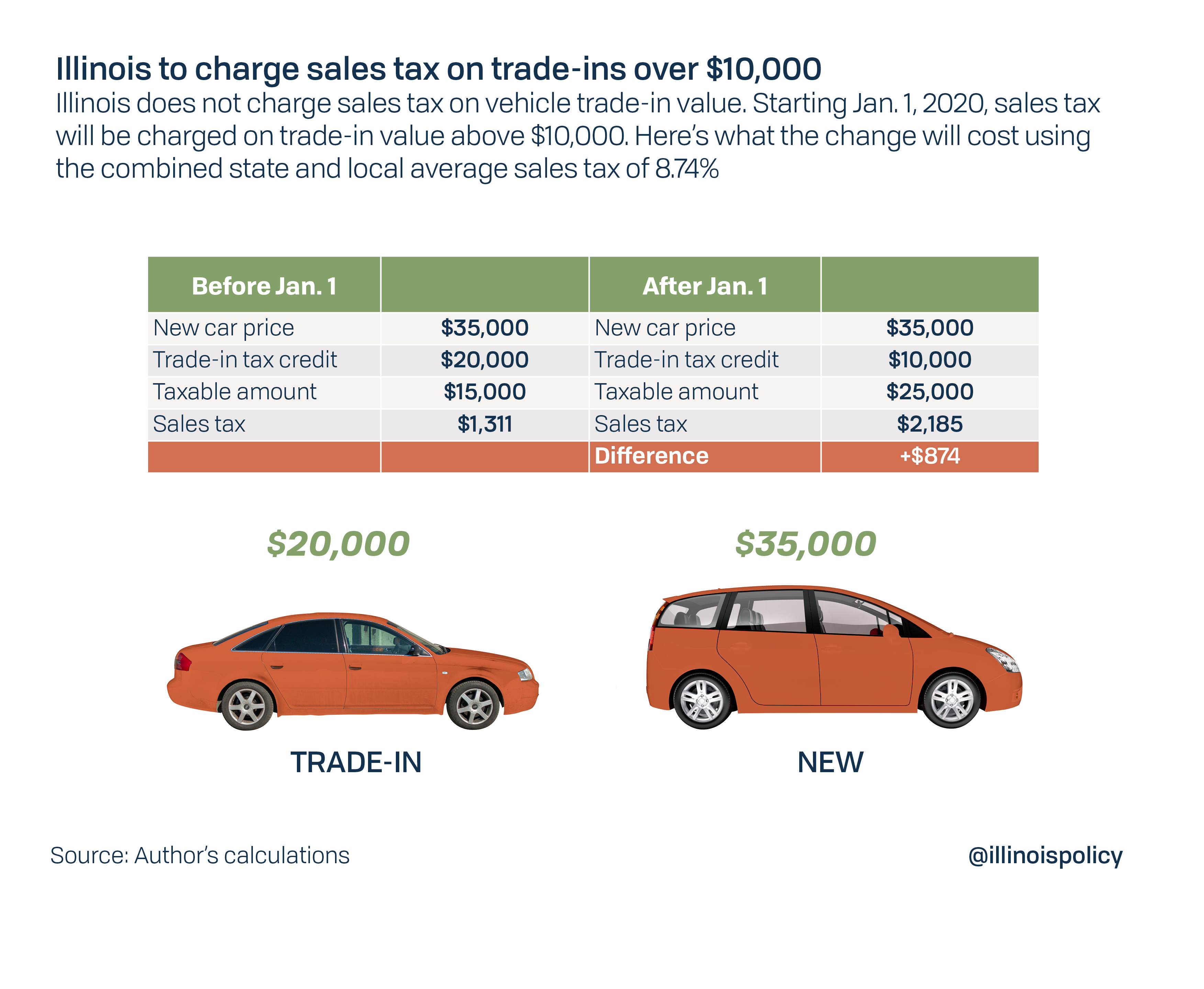

from www.illinoispolicy.org

illinois private party vehicle use tax is based on the purchase price (or fair market value) of the motor vehicle, with exceptions. when you choose to lease a car in illinois, you’ll pay sales tax on the cost of your new or used car — the key factor is that you’ll. sales taxes in illinois are calculated before rebates are applied, so the buyer who pays $9,500 after a $2,500 rebate will still pay sales tax on the full $12,000. The tax is imposed on motor vehicles purchased (or acquired by gift or transfer) from another individual or private. illinois private party vehicle use tax is based on the purchase price (or fair market value) of the motor vehicle, with exceptions.

Illinois House bills would reverse Pritzker’s car tradein tax

How Much Is Sales Tax On A Vehicle In Illinois illinois private party vehicle use tax is based on the purchase price (or fair market value) of the motor vehicle, with exceptions. sales taxes in illinois are calculated before rebates are applied, so the buyer who pays $9,500 after a $2,500 rebate will still pay sales tax on the full $12,000. The tax is imposed on motor vehicles purchased (or acquired by gift or transfer) from another individual or private. illinois private party vehicle use tax is based on the purchase price (or fair market value) of the motor vehicle, with exceptions. illinois private party vehicle use tax is based on the purchase price (or fair market value) of the motor vehicle, with exceptions. when you choose to lease a car in illinois, you’ll pay sales tax on the cost of your new or used car — the key factor is that you’ll.

From www.formsbank.com

Fillable Rut25X, Amended Vehicle Use Tax Transaction Return How Much Is Sales Tax On A Vehicle In Illinois illinois private party vehicle use tax is based on the purchase price (or fair market value) of the motor vehicle, with exceptions. illinois private party vehicle use tax is based on the purchase price (or fair market value) of the motor vehicle, with exceptions. The tax is imposed on motor vehicles purchased (or acquired by gift or transfer). How Much Is Sales Tax On A Vehicle In Illinois.

From taxsalestoday.blogspot.com

Tax Sales Illinois Tax Sales Rate How Much Is Sales Tax On A Vehicle In Illinois illinois private party vehicle use tax is based on the purchase price (or fair market value) of the motor vehicle, with exceptions. when you choose to lease a car in illinois, you’ll pay sales tax on the cost of your new or used car — the key factor is that you’ll. The tax is imposed on motor vehicles. How Much Is Sales Tax On A Vehicle In Illinois.

From www.youtube.com

Illinois Sales Tax Explained Rates, Forms, Registrations, and More How Much Is Sales Tax On A Vehicle In Illinois The tax is imposed on motor vehicles purchased (or acquired by gift or transfer) from another individual or private. illinois private party vehicle use tax is based on the purchase price (or fair market value) of the motor vehicle, with exceptions. sales taxes in illinois are calculated before rebates are applied, so the buyer who pays $9,500 after. How Much Is Sales Tax On A Vehicle In Illinois.

From legaltemplates.net

Free Illinois Bill of Sale Forms PDF & Word Legal Templates How Much Is Sales Tax On A Vehicle In Illinois sales taxes in illinois are calculated before rebates are applied, so the buyer who pays $9,500 after a $2,500 rebate will still pay sales tax on the full $12,000. illinois private party vehicle use tax is based on the purchase price (or fair market value) of the motor vehicle, with exceptions. The tax is imposed on motor vehicles. How Much Is Sales Tax On A Vehicle In Illinois.

From www.illinoispolicy.org

Illinois House bills would reverse Pritzker’s car tradein tax How Much Is Sales Tax On A Vehicle In Illinois illinois private party vehicle use tax is based on the purchase price (or fair market value) of the motor vehicle, with exceptions. illinois private party vehicle use tax is based on the purchase price (or fair market value) of the motor vehicle, with exceptions. The tax is imposed on motor vehicles purchased (or acquired by gift or transfer). How Much Is Sales Tax On A Vehicle In Illinois.

From taxfoundation.org

Sales Tax Reliance How Much Does Your State Rely on Sales Taxes? How Much Is Sales Tax On A Vehicle In Illinois when you choose to lease a car in illinois, you’ll pay sales tax on the cost of your new or used car — the key factor is that you’ll. sales taxes in illinois are calculated before rebates are applied, so the buyer who pays $9,500 after a $2,500 rebate will still pay sales tax on the full $12,000.. How Much Is Sales Tax On A Vehicle In Illinois.

From www.carsalerental.com

How To Figure Sales Tax On A Car Car Sale and Rentals How Much Is Sales Tax On A Vehicle In Illinois when you choose to lease a car in illinois, you’ll pay sales tax on the cost of your new or used car — the key factor is that you’ll. illinois private party vehicle use tax is based on the purchase price (or fair market value) of the motor vehicle, with exceptions. The tax is imposed on motor vehicles. How Much Is Sales Tax On A Vehicle In Illinois.

From agnabetheline.pages.dev

Illinois Sales Tax C … Stace Julissa How Much Is Sales Tax On A Vehicle In Illinois illinois private party vehicle use tax is based on the purchase price (or fair market value) of the motor vehicle, with exceptions. The tax is imposed on motor vehicles purchased (or acquired by gift or transfer) from another individual or private. sales taxes in illinois are calculated before rebates are applied, so the buyer who pays $9,500 after. How Much Is Sales Tax On A Vehicle In Illinois.

From exozhhwmx.blob.core.windows.net

Used Car Illinois Sales Tax at Terry Shuler blog How Much Is Sales Tax On A Vehicle In Illinois The tax is imposed on motor vehicles purchased (or acquired by gift or transfer) from another individual or private. illinois private party vehicle use tax is based on the purchase price (or fair market value) of the motor vehicle, with exceptions. sales taxes in illinois are calculated before rebates are applied, so the buyer who pays $9,500 after. How Much Is Sales Tax On A Vehicle In Illinois.

From www.taxpayereducation.org

ILLINOIS SALES TAX RATES AMONG THE HIGHEST IN THE COUNTRY! Taxpayer How Much Is Sales Tax On A Vehicle In Illinois when you choose to lease a car in illinois, you’ll pay sales tax on the cost of your new or used car — the key factor is that you’ll. sales taxes in illinois are calculated before rebates are applied, so the buyer who pays $9,500 after a $2,500 rebate will still pay sales tax on the full $12,000.. How Much Is Sales Tax On A Vehicle In Illinois.

From ledgergurus.com

Illinois Sales Tax Explained 2021 How Much Is Sales Tax On A Vehicle In Illinois sales taxes in illinois are calculated before rebates are applied, so the buyer who pays $9,500 after a $2,500 rebate will still pay sales tax on the full $12,000. when you choose to lease a car in illinois, you’ll pay sales tax on the cost of your new or used car — the key factor is that you’ll.. How Much Is Sales Tax On A Vehicle In Illinois.

From taxfoundation.org

How High Are Sales Taxes in Your State? Tax Foundation How Much Is Sales Tax On A Vehicle In Illinois sales taxes in illinois are calculated before rebates are applied, so the buyer who pays $9,500 after a $2,500 rebate will still pay sales tax on the full $12,000. The tax is imposed on motor vehicles purchased (or acquired by gift or transfer) from another individual or private. illinois private party vehicle use tax is based on the. How Much Is Sales Tax On A Vehicle In Illinois.

From dxolsfeet.blob.core.windows.net

Vehicle Sales Tax Il at Joshua Smith blog How Much Is Sales Tax On A Vehicle In Illinois illinois private party vehicle use tax is based on the purchase price (or fair market value) of the motor vehicle, with exceptions. when you choose to lease a car in illinois, you’ll pay sales tax on the cost of your new or used car — the key factor is that you’ll. The tax is imposed on motor vehicles. How Much Is Sales Tax On A Vehicle In Illinois.

From webinarcare.com

How to Get Illinois Sales Tax Permit A Comprehensive Guide How Much Is Sales Tax On A Vehicle In Illinois The tax is imposed on motor vehicles purchased (or acquired by gift or transfer) from another individual or private. illinois private party vehicle use tax is based on the purchase price (or fair market value) of the motor vehicle, with exceptions. illinois private party vehicle use tax is based on the purchase price (or fair market value) of. How Much Is Sales Tax On A Vehicle In Illinois.

From 2020blog.us

States With the Highest Sales Taxes 2020 Blogging How Much Is Sales Tax On A Vehicle In Illinois when you choose to lease a car in illinois, you’ll pay sales tax on the cost of your new or used car — the key factor is that you’ll. The tax is imposed on motor vehicles purchased (or acquired by gift or transfer) from another individual or private. illinois private party vehicle use tax is based on the. How Much Is Sales Tax On A Vehicle In Illinois.

From www.illinoispolicy.org

Chicago now home to the nation’s highest sales tax How Much Is Sales Tax On A Vehicle In Illinois illinois private party vehicle use tax is based on the purchase price (or fair market value) of the motor vehicle, with exceptions. when you choose to lease a car in illinois, you’ll pay sales tax on the cost of your new or used car — the key factor is that you’ll. illinois private party vehicle use tax. How Much Is Sales Tax On A Vehicle In Illinois.

From taxfoundation.org

State Sales Tax Collections per Capita Tax Foundation How Much Is Sales Tax On A Vehicle In Illinois illinois private party vehicle use tax is based on the purchase price (or fair market value) of the motor vehicle, with exceptions. sales taxes in illinois are calculated before rebates are applied, so the buyer who pays $9,500 after a $2,500 rebate will still pay sales tax on the full $12,000. when you choose to lease a. How Much Is Sales Tax On A Vehicle In Illinois.

From quizzdbbackovnc.z13.web.core.windows.net

State And Local Sales Tax Rates 2020 How Much Is Sales Tax On A Vehicle In Illinois sales taxes in illinois are calculated before rebates are applied, so the buyer who pays $9,500 after a $2,500 rebate will still pay sales tax on the full $12,000. illinois private party vehicle use tax is based on the purchase price (or fair market value) of the motor vehicle, with exceptions. The tax is imposed on motor vehicles. How Much Is Sales Tax On A Vehicle In Illinois.